Installment Open End Credit Example

For example, iowa’s regulated loan act caps interest at 36% on the first $1,000, 24% on the next $1800, and 18% on the remainder. 1st is revolving credit which is like mbna, capital one,mastercard, visa, orchard bank, etc.

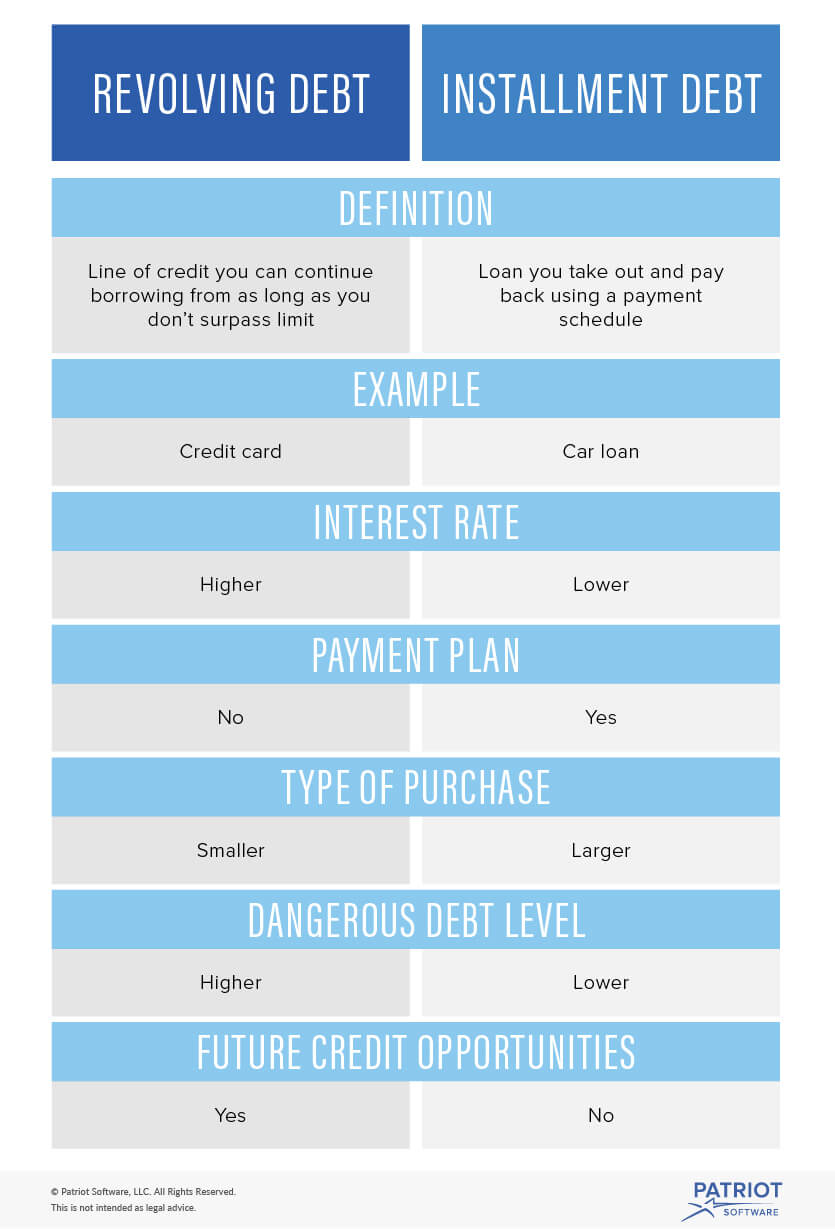

Revolving Credit Vs Installment Credit - Nerdwallet

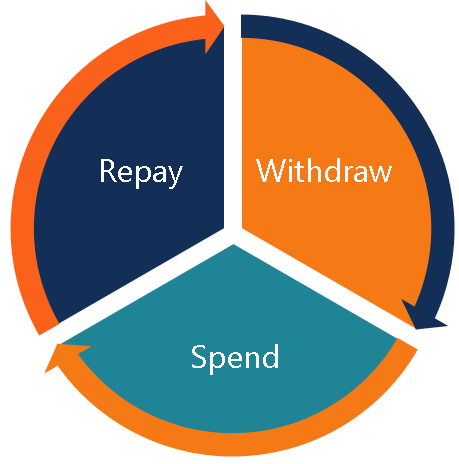

With a credit card you have a certain amount of credit to use.

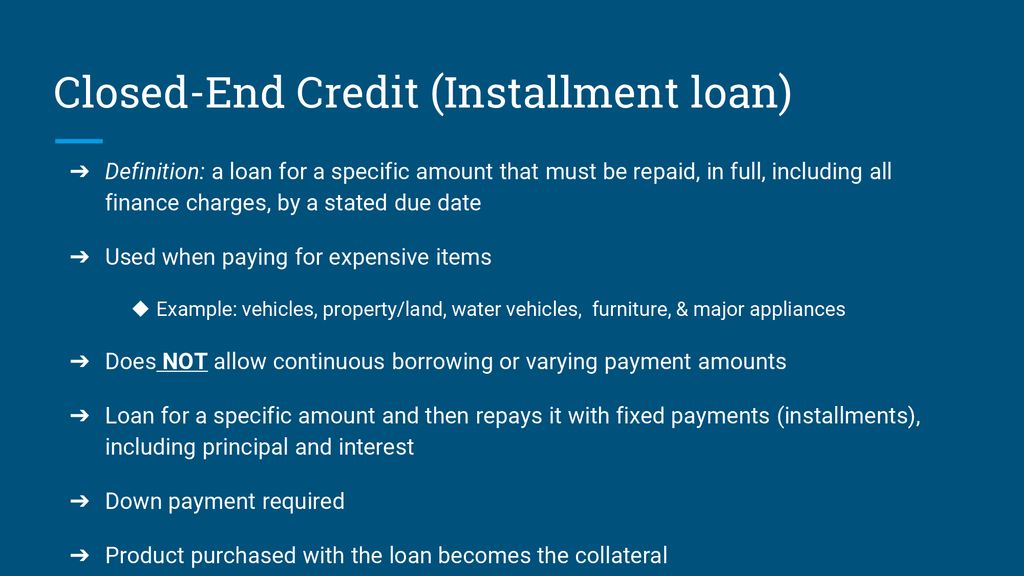

Installment open end credit example. Installment credit is likely what comes to mind when you think of the word “loan.” an installment account is one where you borrow a fixed amount of money and then make regular payments of a specific amount on the loan until you’ve paid it off. For example, let's assume you take out a loan. A) single lump sum of credit b) an installment loan for purchasing furniture c) a mortgage loan d) a department store credit card e) an automobile loan

If you want to borrow more money, you have to apply for another loan. E) installment loan for purchasing a major appliance. Summary an open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit.

On a revolving credit account, you decide how much to charge every month and how much to repay. These amounts are amortized to include a certain amount of principal and interest calculated over a set number of months. 4.explain the term upside down in reference to a car loan or home loan.

Give an example of each. Installment loan for purchasing a major appliance 60. Mortgages are essentially a strategy for providing an extension of credit to purchase the home.

A bank’s installment lending portfolio is usually comprised of secured or unsecured small 1.list 5 signs of being in overindebtedness. Open end credit allows you to make repeat purchases.

The use of a bank card to make a purchase. 1.list 5 signs of being in overindebtedness. Unlike an installment credit account, a revolving credit account lets you carry a balance from month to month.

The resulting apr, which blends these rates, is 31% on a $2000 loan. When you carry a balance from month to month,. The mortgage loan from a savings and loan institution.

An installment loan can also be referred to as installment debt. In contrast to installment credit, revolving credit extends borrowers a line of credit with no determined end time, and they can spend up to their assigned credit limit. $280 per month) until the loan is paid off in full.

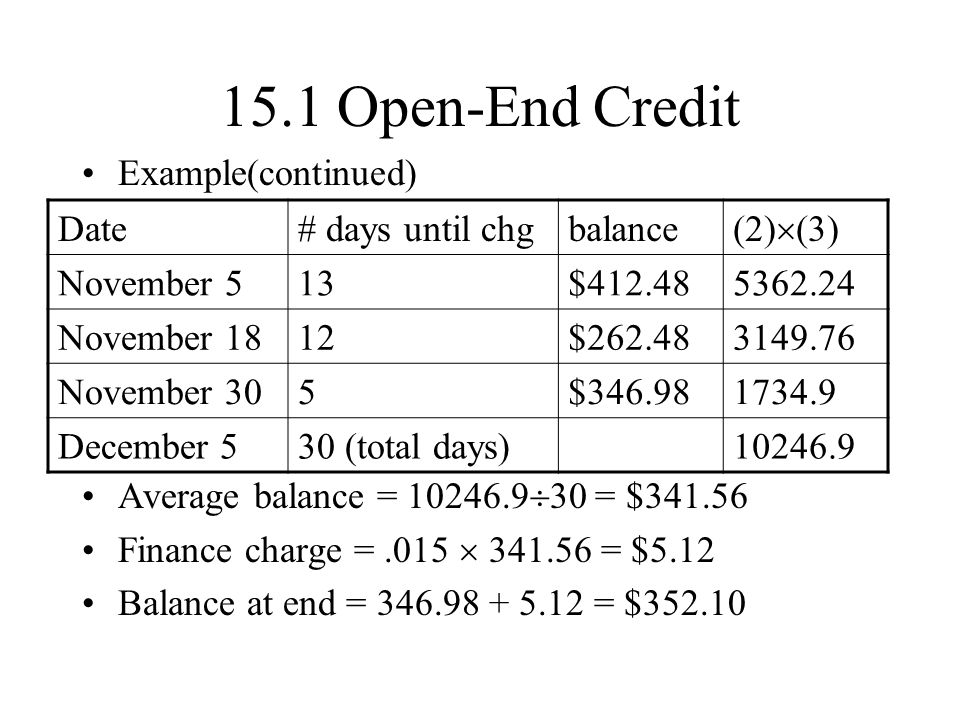

The first payment amount is labeled as an estimate since the transaction date is uncertain. You can pay the balance in full each month or make installment payments. Thisis when a store or company issues a card with credit line say$1000.

The date of the transaction is expected to be april 15, 1981, with the first payment due on june 1, 1981. Automobile loan from a credit union. This sample illustrates an installment loan.

That’s a credit utilization of 50% ($5,000 ÷ $10,000), which is 20% higher than the. The amount of the loan is $5,000. Open end credit this is a type of credit loan paid on.

B) the mortgage loan from a savings and loan institution. Say, for example, you have $5,000 in outstanding revolving credit and the sum of your revolving credit lines is $10,000. C) automobile loan from a credit union.

Installment loans are another type of credit that includes a fixed payment schedule for a specified duration. An installment loan is granted to a borrower with a fixed number of monthly payments that are of equal amount. You can keep the credit line open forever, hence the term open end credit.

There is a 12% simple interest rate and a term of 2 years. The structure of the credit will involve the application of a rate of. You are obligated to repay the amount of credit that you have used.

An example of an installment loan would be a car loan — you are required to pay a set amount of money at a recurring interval (ex. D) installment loan from a furniture store. 3.explain the difference between an unsecured loan /signature loan and a secured loan.

How are installment credit and revolving credit different? By taking out a personal loan, which is installment credit, and using those funds to pay down your revolving credit outstanding balances. Examples of installment type loans are car loans,.

Rate caps are often structured based on tiers of credit. Credit cards and home equity lines of credit are examples of revolving accounts. Installment loan from a furniture store.

Credit The Four Most Common Forms Christian Credit Counselors

Lesson 162 Types Sources Of Credit - Ppt Download

Lesson 162 Types Sources Of Credit - Ppt Download

Consumer Credit Regulation Nclc Digital Library

Types Of Credit - Definitions Examples Questions

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed-end Credit Vs An Open Line Of Credit

What Are Three Types Of Consumer Credit

Lesson 162 Types Sources Of Credit - Ppt Download

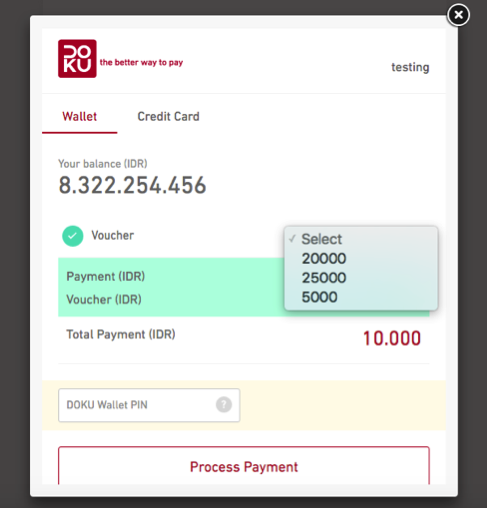

Introduction Doku Payment Api Documentation

Line Of Credit Vs Installment Loan Moneykey

Introduction Doku Payment Api Documentation

How To Read Your Credit Card Statement - Rbc Royal Bank

Math In Our World Section 84 Installment Buying - Ppt Video Online Download

Revolving Debt Vs Installment Debt Whats The Difference

3 Ways To Calculate An Installment Loan Payment - Wikihow

What Are Three Types Of Consumer Credit

Understanding Different Types Of Credit Nextadvisor With Time

Sample Credit Card Debt Settlement Letter Download Printable Pdf Templateroller

131 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded - Ppt Video Online Download